reverse sales tax calculator florida

Input the Tax Rate. Florida has a 6 statewide sales tax rate but also has 367 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1037 on top.

Real Estate Capital Gains Calculator Internal Revenue Code Simplified

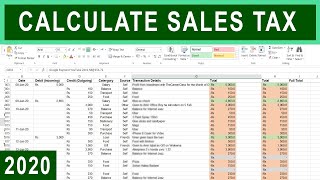

This sales tax calculator is simple.

. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Advanced searches left. Next a sales tax is calculated as well as a total purchase price including sales tax.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Why A Reverse Sales Tax Calculator is Useful. Reverse Sales Tax Calculator - 100 Free - Calculatorsio.

For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim. A reverse tax audit done by a knowledgeable Florida tax professional is performed to determine if there have been overpayments of Florida taxes.

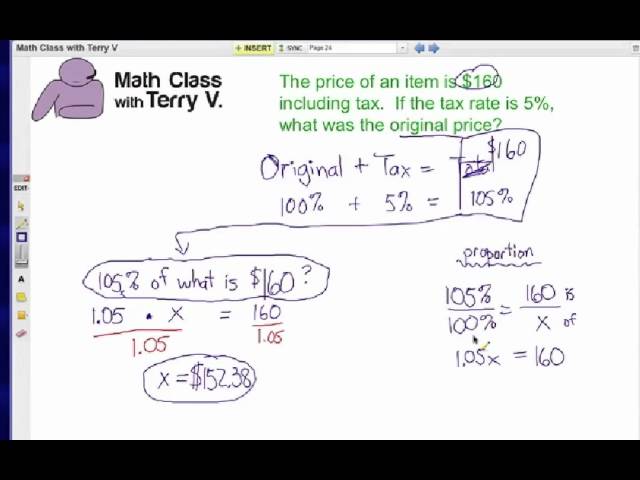

Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax. The reverse sales tax calculator is the easiest and very handy calculator for computing the actual price if you input the sales tax rate and the sale price you paid for a good or service. It is 8156 of the total taxes 431 billion raised in Florida.

Our Reverse Sales Tax Calculator accepts two inputs. Enter the sales tax percentage. Following is the reverse sales tax formula on how to calculate reverse tax.

Amount without sales tax GST rate GST amount. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. Instead of using the reverse sales tax calculator you can compute this manuallyTo find the original price of an item you need this formula.

We can not guarantee its accuracy. Tax 6200 0075. Definition of Reverse Sales Tax Have you ever questioned how much you paid for anything before sales tax was applied or if the sales tax on your receipt was accurate.

Before Tax Price - The price of the purchase before sales tax is added. A Reverse Sales Tax Calculator is very useful for tax purpose because if you itemize your deductions and claim credit for the overpaid local and out-of-state sales taxes on your taxes. Reverse Sales Tax Calculator.

A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. If you know the total sales price and the sales tax percentage it will calculate the base price before taxes and. Reverse Sales Tax Calculator Calculating Sales Tax.

Like income tax calculating sales tax often isnt as simple as X amount of money Y amount of state tax In Texas for example the state imposes a 625 percent sales tax as of 2018. Amount without sales tax QST rate QST amount. That entry would be 0775 for the percentage.

Search only database of. Firstly divide the tax rate by 100. Please check the value of Sales Tax in other sources to ensure that it is the correct value.

You can use an online reverse sales tax calculator or figure it out yourself with a reverse sales tax formula. All you have to input is the amount of sales tax you paid and the final price on your. Home Blog Pro Plans B2B solution Login.

Sales and Gross Receipts Taxes in Florida amounts to 352 billion. PRETAX PRICE POSTTAX PRICE 1 TAX RATE. Here is how the total is calculated before sales tax.

4 on amusement machine receipts 55 on the lease or license of commercial real property and 695 on electricity. Instead of using the reverse sales tax calculator you can compute this manually. OP with sales tax OP tax rate in decimal form 1 But theres also another method to find an items original price.

Formula s to Calculate Reverse Sales Tax. Now find the tax value by multiplying tax rate by the before tax price. These are the types of refunds that a Florida Department of Revenue agent may never even mention to you.

Collected from the entire web and summarized to include only the most important parts of it. Selling Price Final Price 1 Sales Tax. If you buy a taxable item in Florida.

This is especially beneficial if you have to list your out-of-state purchases to you current state of residence and the taxes paid on those purchases. Input the Final Price Including Tax price plus tax added on. Order Now Offer Details.

Reverse Sales Tax Calculator Remove Tax. OP with sales tax OP tax rate in decimal form 1. 75100 0075 tax rate as a decimal.

Floridas general state sales tax rate is 6 with the following exceptions. Tax 465 tax value rouded to 2 decimals. The second script is the reverse of the first.

In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Finding how much sales tax you paid on an article is quite easy but knowing the actual cost requires a reverse calculation. Use tax is due on the use or consumption of taxable goods or services when sales tax was not paid at the time of purchase.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. To easily divide by 100 just move the decimal point two spaces to the left. There are times when you may want to find out the original price of the items youve purchased before tax.

Sales Tax Glossary of Terms. Whether initiated during a Florida DOR audit or as a completely separate engagement a Florida. 52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you.

To find the original price of an item you need this formula. Enter your before tax purchase price followed by the sales tax rate in your area. Reverse Sales Tax Formula.

Numbers represent only state taxes not. Can be used as content for research and analysis. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Florida local counties cities and special taxation districts.

This script calculates the Before Tax Price and the Tax Value being charged. Sales Tax Rate - The total rate of sales tax charged on a purchase.

How To Find Original Price Tax 1 Youtube

Cryptocurrency Taxes What To Know For 2021 Money

The Impact Of Hybrid Work On Commuters And Nyc Sales Tax Office Of The New York City Comptroller Brad Lander

Reverse Sales Tax Calculator 100 Free Calculators Io

Gst Composition Scheme May Come Under Reverse Charge Mechanism

Us Sales Tax Calculator Reverse Sales Dremployee

Shopify S Sales Tax Liability And Nexus Dashboard Results Explained Taxvalet

Sales Tax Guide For Online Courses

Kentucky Sales Tax Calculator Reverse Sales Dremployee

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

How To Calculate Sales Tax In Excel Tutorial Youtube

Florida Business Owner Pleads Guilty To Tax Evasion Faces Federal Prison

Real Estate Property Tax Constitutional Tax Collector

Reverse Sales Tax Calculator 100 Free Calculators Io

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Florida Car Sales Tax Everything You Need To Know

Reverse Sales Tax Calculator De Calculator Accounting Portal